missouri gas tax refund

You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. Vehicle weighs less than 26000 pounds vehicle for highway use fuel bought on or after Oct.

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

This app allows you to track your gas spending add vehicles and gas stations and access the 4923-H forum to ensure that you will.

. However the receipts from fueling stations do not provide this information. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. 25 cents in 2022 5 cents in 2023 75 cents in 2024 10.

To search type in a keyword andor choose a category. Vehicles under 26000 pounds and registered in the state of Missouri are eligible for a refund. 1 until the tax hits 295 cents per gallon in July 2025.

Its estimated the state would receive an estimated 500 million when fully implemented paying for. According to State Representatives Randy. July 1st 2024 Missouri gas tax increases to 027.

262 calls for an increase of 25 cents per year over a five-year period as follows. Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025. Good candidates for these refunds are primarily businesses that purchase significant motor fuel for use in light to medium duty vehicles.

With the passage of Senate Bill 262 the Missouri Department of Revenue made changes to some of the forms used when requesting a refund of taxes paid on Missouri motor fuel used for non-highway purposesPlease refer to the Motor Fuel Tax Non-Highway Form Updates for more information. July 1st 2023 Missouri gas tax increases to 0245. 10120216302022 Motor Fuel Tax Rate increases to.

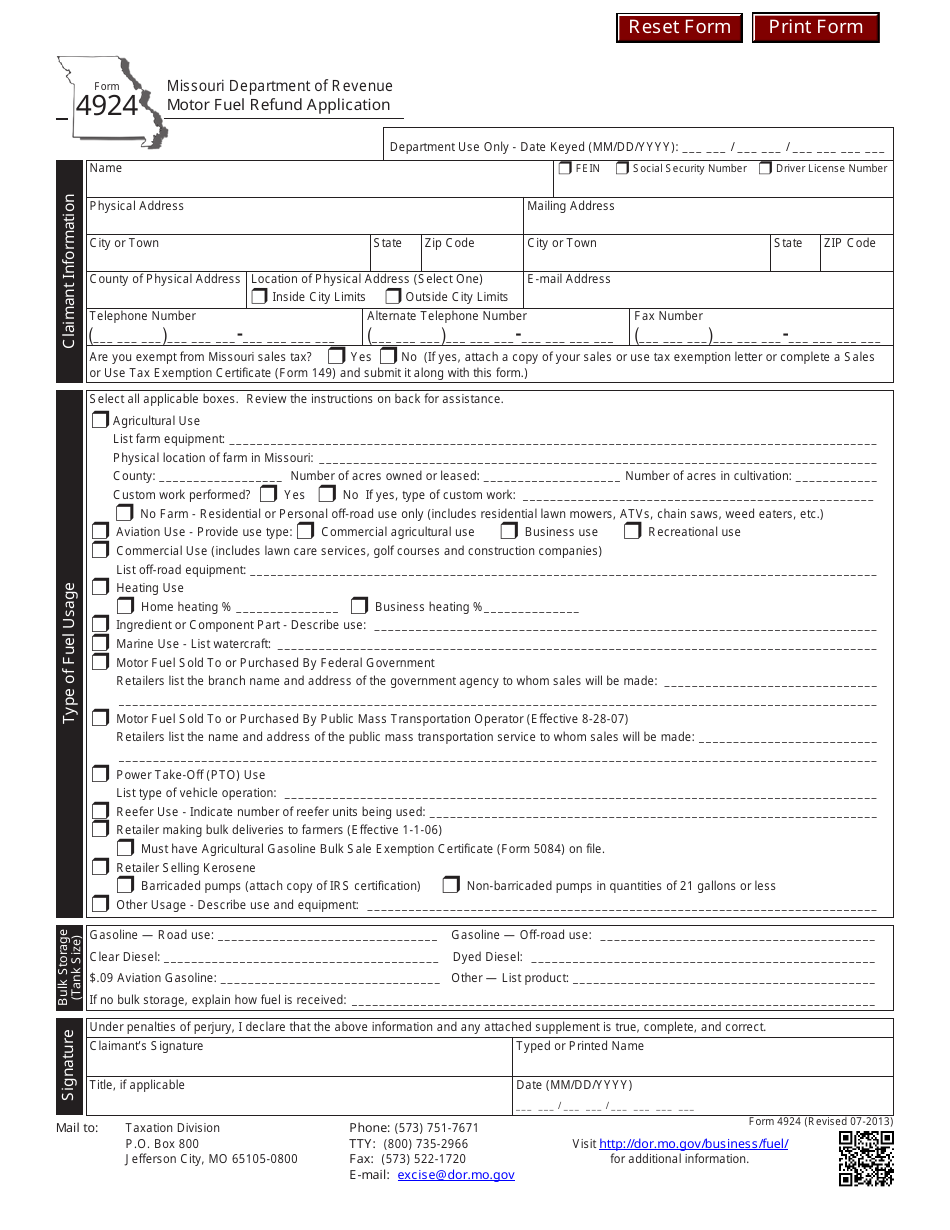

The Departments motor fuel tax refund claim forms require the amount of Missouri motor fuel tax paid to be listed as a separate item. Form 4923 must be accompanied with the applicable Form 4923S Statement of Missouri Fuel Tax Paid for Non-Highway Use. The states gas tax is set to increase by 25 cents on the first of the month part of a 2021 law that gradually increases it annually over the next few years.

Under SB 262 you may request a refund of the Missouri motor fuel tax increase paid each year. The current tax is 22 cents as of July 1st. The states additional gas tax went up to five cents a gallon July 1.

Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Instructions for completing form. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

The tax is passed on to the ultimate consumer purchasing fuel at retail. Section 142822 Motor Fuel Tax Law To claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes the taxpayer must file a refund claim. 1 2021 through June 30 2022.

The state gas tax will increase by 25 cents each year until it reaches 295 cents in 2025. The bill passed in 2021 says Missouri drivers who keep their gas receipts between October 1 2021 and June 30 2022 can request a full refund of the additional taxes paid. The information will be retained in the Missouri Department of Revenues files.

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for. The refund provision only applies to the new tax. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program. Check For The Latest Updates And Resources Throughout The Tax Season. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase.

LOUIS You still have time to file a claim for a gas tax refund. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. July 1st 2022 Missouri gas tax increases to 022.

Ad Fill Sign Email MO 4923 More Fillable Forms Register and Subscribe Now. When the state of Missouri passed a law to increase its gas tax lawmakers also promised a. Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund is claimed.

The Missouri Department of Revenue said as of July 15 theyve received 3175 gas. The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. However drivers can claim a refund for up to 25 cents on the increased tax.

How do I calculate the Missouri tax. Must be submitted with initial non-highway motor fuel refund claim Form 4923 Instructions for Completing Non-Highway Motor Fuel Refund Claim This Non-Highway Use Motor Fuel Refund Application Form 4924 must be completed to substantiate your refund claims. Ad Download or Email MO 4923 More Fillable Forms Register and Subscribe Now.

25 cents in 2022 5 cents in 2023 75 cents in 2024 10 cents in 2025 125 cents in 2026 Relief for Missouris Drivers. NoMOGasTax app is built in response to Missouri Senate Bill 262 which increased the gas tax by 0025 cents per gallon every year for the next 5 years. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts.

Missouri Department Of Revenue

Missouri Lawmakers Pass Fuel Tax Hike With Refund Option Transport Topics

How To Get Your Gas Tax Refund By Using Forms From The Missouri Department Of Revenue

Local News Online Gas Tax Refund Claim Form Now Available 6 3 22 Southeast Missourian Newspaper Cape Girardeau Mo

Missouri Fuel Tax Refund May Not Be Worth It Here S Why Youtube

Missouri Drivers Can Get A Refund From The State On The Increased Gas Tax State News Komu Com

Missouri Fuel Tax Refund May Not Be Worth It Here S Why Youtube

Form 4924 Download Fillable Pdf Or Fill Online Motor Fuel Refund Application Missouri Templateroller

Local News Online Gas Tax Refund Claim Form Now Available 6 3 22 Southeast Missourian Newspaper Cape Girardeau Mo

Missouri S Gas Tax Rising Friday Refund Requests Now Open Ksnf Kode Fourstateshomepage Com

Local News Online Gas Tax Refund Claim Form Now Available 6 3 22 Southeast Missourian Newspaper Cape Girardeau Mo

How To Get Your Gas Tax Refund By Using Forms From The Missouri Department Of Revenue

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

State To Begin Accepting Gas Tax Refund Claims

Nomogastax App Gives Missourians The Option To Get Their

Missouri S Gas Tax Going Up Again Friday As Hike In Illinois Suspended For 6 Months Politics Stltoday Com